The EU is matching President Trump’s 90-day pause and preparing for trade negotiations. President Donald Trump implemented dozens of steep tariffs last week, largely implementing half the percentage…

Read MoreEconomy

White House Reports Countries Willing to Negotiate on Tariffs

President Trump responds to China increasing tariffs. The White House reported on Monday that over 50 nations have been in touch with the White House to negotiate regarding…

Read MoreLabor Department Releases March Employment Numbers

The number of jobs added to the economy exceeded expectations. The U.S. Labor Department reported that employment numbers for March exceeded the amount predicted by economics by nearly…

Read MoreU.S. Trade Representative Speaks on President’s Tariff Strategy

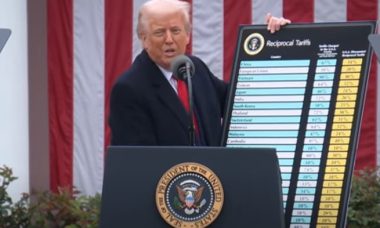

The U.S. has faced high export fees for decades as international goods have flowed into the nation with low or no tariffs. United States Trade Representative Jamieson Greer…

Read MoreSenate Passes Resolution to Block Tariffs Against Canada

Senators in the majority cross the aisle to spare their home states’ economies. Senators Susan Collins of Maine, Rand Paul of Kentucky, Mitch McConnell of Kentucky, and Lisa…

Read MoreEnergy Department Approves LNG Export Project in Louisiana

Venture Global’s CP2 terminal gains conditional approval to boost U.S. energy exports. U.S. Secretary of Energy Chris Wright recently approved the export of liquefied natural gas (LNG) from…

Read MoreLouis DeJoy Resigns as Postmaster General

President Trump proposes having the Commerce Department run USPS. Louis DeJoy resigned as the Postmaster General of the U.S. Postal Service (USPS) on Monday. “While our management team…

Read MorePresident Trump Threatens Tariffs on Venezuelan Oil Purchases

He faults Venezuela for sending criminals and gang members to the U.S. President Donald Trump threatened to impose 25 percent tariffs on any country that purchases oil from…

Read MoreFCC Chair Requests Congress Renew Auction Authority

He states that opening mid-band spectrum will support the economy and national security. Federal Communications Commission Chair Brendan Carr wrote a letter urging Congress to restore his agency’s…

Read MoreTreasury Secretary Responds to Recession Concerns

He says that corrections are normal and recession cannot be ruled out. U.S. Treasury Secretary Scott Bessent recently said that there are “no guarantees“ when it comes to…

Read More