His executive order also mandates building a system to track travel and other expenditures. President Donald Trump signed an executive order last week requiring all agencies to review…

Read MoreCredit Card

Senators Introduce Bill to Cap Credit Card Interest

Senators Hawley and Sanders seek to limit credit card interest rates to 10 percent. Senators Josh Hawley of Missouri and Bernie Sanders of Vermont jointly introduced a bill…

Read MoreTricare West Region Extends Payment Setup Deadline for Beneficiaries

New military health contractor TriWest Healthcare Alliance offers a grace period for recurring payment updates Beneficiaries in Tricare’s West Region now have extended deadlines to set up recurring…

Read MoreTreasury Secretary Leads Financial Literacy and Education Meeting

She reviews the implementation required for the Treasury’s financial inclusion strategy. Secretary of the Treasury Janet Yellen spoke at a meeting of the Financial Literacy and Education Commission…

Read MoreFTC Issues Refunds to Consumers Misled by Credit Karma’s False “Pre-Approval” Claims

Refunds target misleading credit offers promising high odds of approval. The Federal Trade Commission (FTC) is distributing more than $2.5 million to nearly 51,000 consumers misled by Credit…

Read MoreNew Jersey Bank Agrees to Settlement with DOJ and HUD Over Redlining Allegations

The institution also agreed to five-year compliance training for the Fair Housing Act. New Jersey’s OceanFirst Bank filed a proposed settlement agreeing to pay $15.1 million to settle…

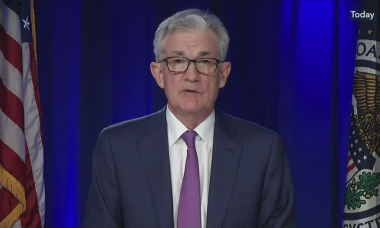

Read MoreFederal Reserve Board Cuts Prime Rate 50 Basis Points

The central bank was motivated by the change in the employment rate, among other factors. The Federal Reserve cut interest rates by half a point on Wednesday, an…

Read MoreSEC Imposes $3 Million in Charges Against 7 Companies for Whistleblower Violations

Companies agree to remediate charges of impeding whistleblower communications. The Securities and Exchange Commission (SEC) announced that seven companies have agreed to pay a collective $3 million to…

Read MorePresident’s Administration Continues to Address Late Credit Payment Fees

Interagency cooperation and new provisions focus on consumer protection from fee hikes. Multiple agencies in President Biden’s administration recently announced partnerships to address price hikes and industry “junk…

Read MoreHHS Highlights New Research to Avoid Data-Based Discrimination

The director of the study says decisions must be made intentionally to “mitigate and prevent racial and ethnic bias.“ The Department of Health and Human Services (HHS) highlighted…

Read More