Expands program to include co-owned and co-invested projects.

The Internal Revenue Service (IRS) recently finalized its expansion to clean energy tax credits, allowing co-owners and co-investors in clean energy projects to access the program. Many clean energy projects are co-owned by tax-complex or tax-exempt organizations, like local governments, Tribal entities, rural co-ops, churches, and hospitals. They were previously ineligible for clean energy tax credits since they are not eligible for a variety of other tax credits. This update to the IRS’ clean energy policy will allow these co-owners to receive direct pay from the IRS for expanding clean energy in the United States.

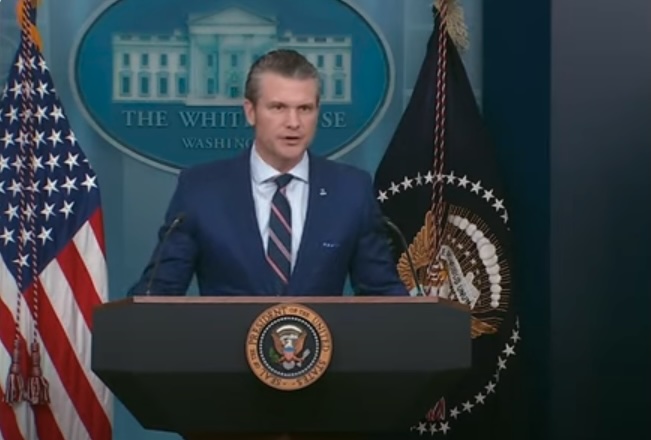

“The Biden-Harris Administration is focused on continuing the clean energy investment boom and ensuring all Americans benefit from the growth of this sector,” said Deputy Treasury Secretary Wally Adeyemo. “Direct pay is helping more clean energy projects be built quickly and affordably, and American communities are benefitting as a result.”

As the Lord Leads, Pray with Us…

- For Deputy Secretary Adeyemo to be prudent in his position in the Treasury Department.

- For Commissioner Danny Werfel to seek the Lord as he heads the IRS.

Sources: Department of the Treasury