The bureau alleges the company published misleading communications about new savings accounts.

The Consumer Financial Protection Bureau (CFPB) has filed a lawsuit against the bank Capital One for violating the violated the Truth in Savings Act, misleading customers about the nature of its new savings account that offered improved interest rates.

CFPB alleges that when Capital One rolled out a new version of its “360 Savings” variable interest rate account called the “360 Performance Savings” account, which offered a higher rate, the bank froze the interest rate of the previous product. The bureau stated, “Capital One did not specifically notify 360 Savings accountholders about the new product, and instead worked to keep them in the dark about these better-paying accounts.“

CFPB Director Rohit Chopra stated, “The CFPB is suing Capital One for cheating families out of billions of dollars on their savings accounts. Banks should not be baiting people with promises they can’t live up to.”

Capital One has denied the allegations and claimed it transparently marketed its 360 Performance Savings account.

As the Lord Leads, Pray with Us…

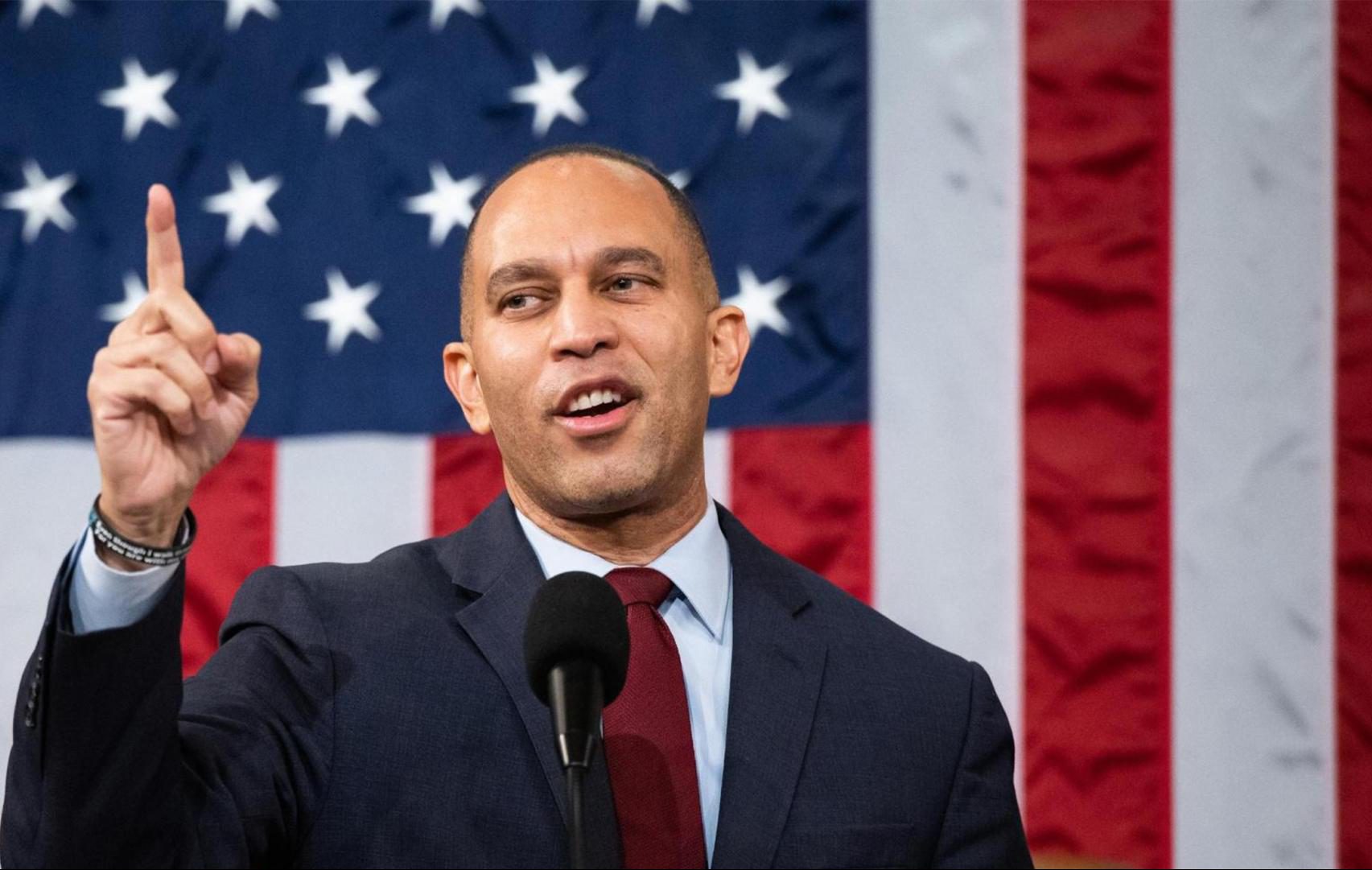

- For officials in the CFPB to be prudent in their analysis and litigation over deceptive marketing practices.

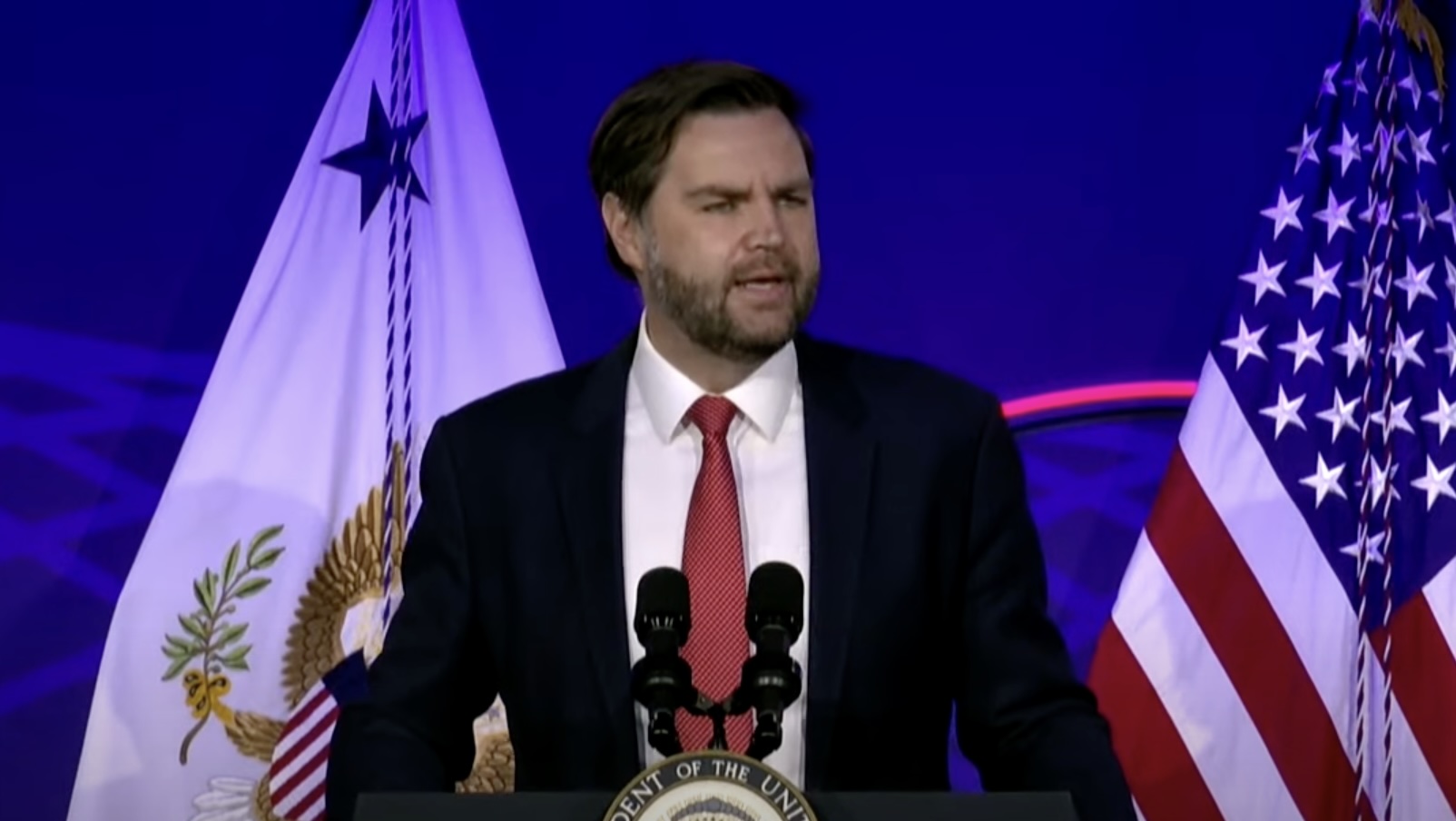

- For President Trump and members of his administration as they evaluate the breadth of federal government agencies and their roles.

Sources: CNBC, Consumer Financial Protection Bureau